Tag: estate planning arizona

- 0

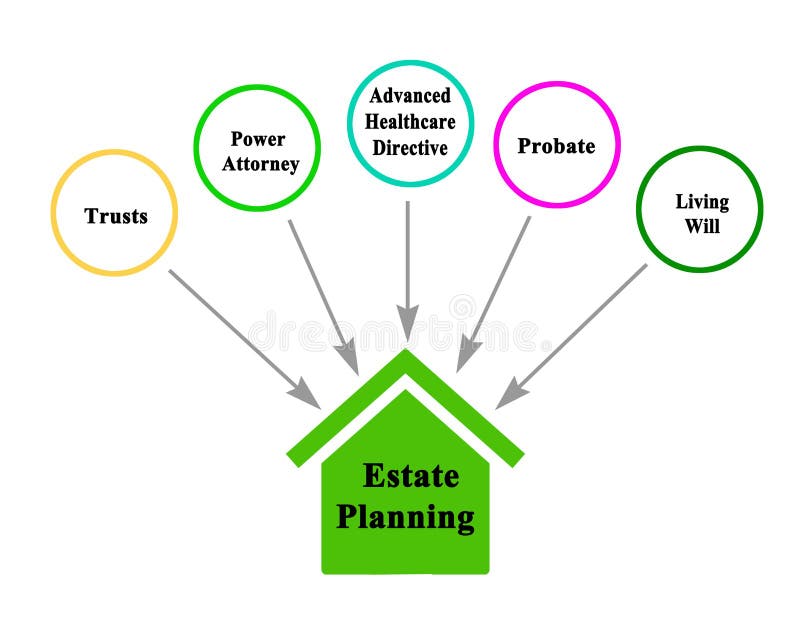

Planning your estate is essential and without it, your loved ones could be required to go through lengthy legal procedures following your death and your final wishes might not be recognized under state probate or the laws governing intestate succession.

Estate planning may take effect prior to your death. If you are gravely ill or incapacitated before you die your estate could fall to your beneficiaries. For instance, if you suffer from a stroke and cannot manage your wealth, a third party is appointed to care for the assets.

In reality, the most frequent error individuals make in planning their estates is not making the effort to plan them properly.

It is essential to designate an official guardian for your children who are minors in an estate plan. You may have believed that planning for your estate solely concerned your personal possessions as well as financial investments.

Joint ownership is another blunder that many people make when planning your estate. It is not uncommon for older people to include a minor child in their title of assets and belongings in order to avoid lengthy legal processes following their death. This can be problematic due to various reasons.

Estate planning isn't just a once-in-a-lifetime occasion. If your plans as well as your financial and other factors change, you might want to alter something in your estate plan.